Research Catered to the Dividend Investor

Dividend Research

Separate Safe Dividends from

those at Risk

Navigating the world of stocks and funds requires effective dividend research. TrackYourDividends can serve as your essential resource for understanding how to evaluate dividend-paying companies. By mastering a few key metrics and strategies, you can move beyond simple yield to build a portfolio that provides reliable, growing income for years to come.

Fundamental Stock Analysis

Dividend Research Data

Sometimes you just want to know a little bit more about a stock. In the past, that meant you had to pull up Yahoo! Finance, Google Finance, or try to find more information at your broker. Now, you can find all the information you need right on TrackYourDividends.

Front and Center you will see the key statistics every dividend investors want to know:

- Forward and Trailing Dividend Yield

- Annual Payment

- Ex-Dividend and Payment Dates

Payout Ratio

The percentage of net income paid out in dividends

TYD Dividend

Safety Score

Likelihood to continue to pay and grow dividend

Dividend Increases

Demonstrates strength and commitment to dividend

Frequently Asked Questions

Researching Dividend Stocks:

Your Questions Answered

Q. What data points should I look at before buying a dividend stock?

Before buying, check these key data points: Dividend Yield (income percentage), Payout Ratio (sustainability), and Dividend Growth Rate (reliability). Also, look at the company’s Free Cash Flow and Debt-to-Equity Ratio to ensure it has the financial health to continue paying dividends.

Learn more about key dividend ratios.

Q. What is the difference between a forward and trailing dividend yield?

The difference between forward and trailing dividend yield is the time frame. A trailing yield is historical, using the dividends paid over the past 12 months. A forward yield is an estimate of future income, based on the company’s expected dividend payments for the next year.

Q. When do I need to buy a stock to receive the dividend?

You must buy the stock before the ex-dividend date. This is the most critical cutoff. If you buy a stock on the ex-dividend date or any day after it, the dividend payment will go to the previous owner. The stock is considered to be “ex-dividend,” or without the dividend. You must own the shares at the close of trading on the day before the ex-dividend date to be an eligible shareholder for that payment. Learn more about key dates.

Q. Where can I find historical dividend payment information?

TrackYourDividends has historical dividend payment information for all U.S. listed securities. Each stock has a dedicated research page including a section showing its complete historical payments. This allows you to easily analyze a company’s track record. In 2025, TrackYourDividends released an AI projection feature of future dividend payments to help with your long-term planning.

Extra Dividend Resources

Research Catered to Dividend Investors

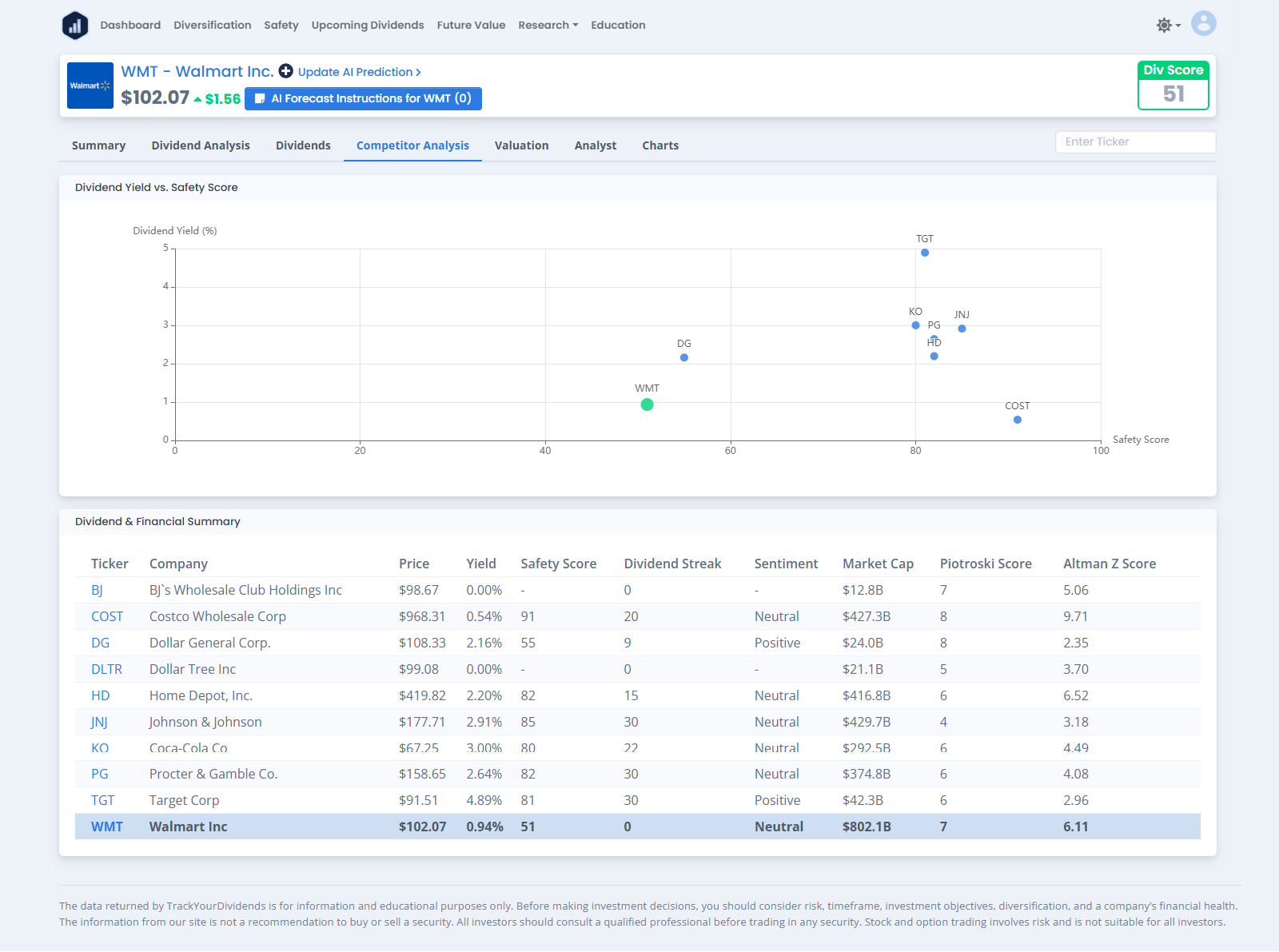

Competitor Analysis

See the company’s top competitors and compare yields, TYD Safety Score, current ratio, P/E, P/S, and P/B

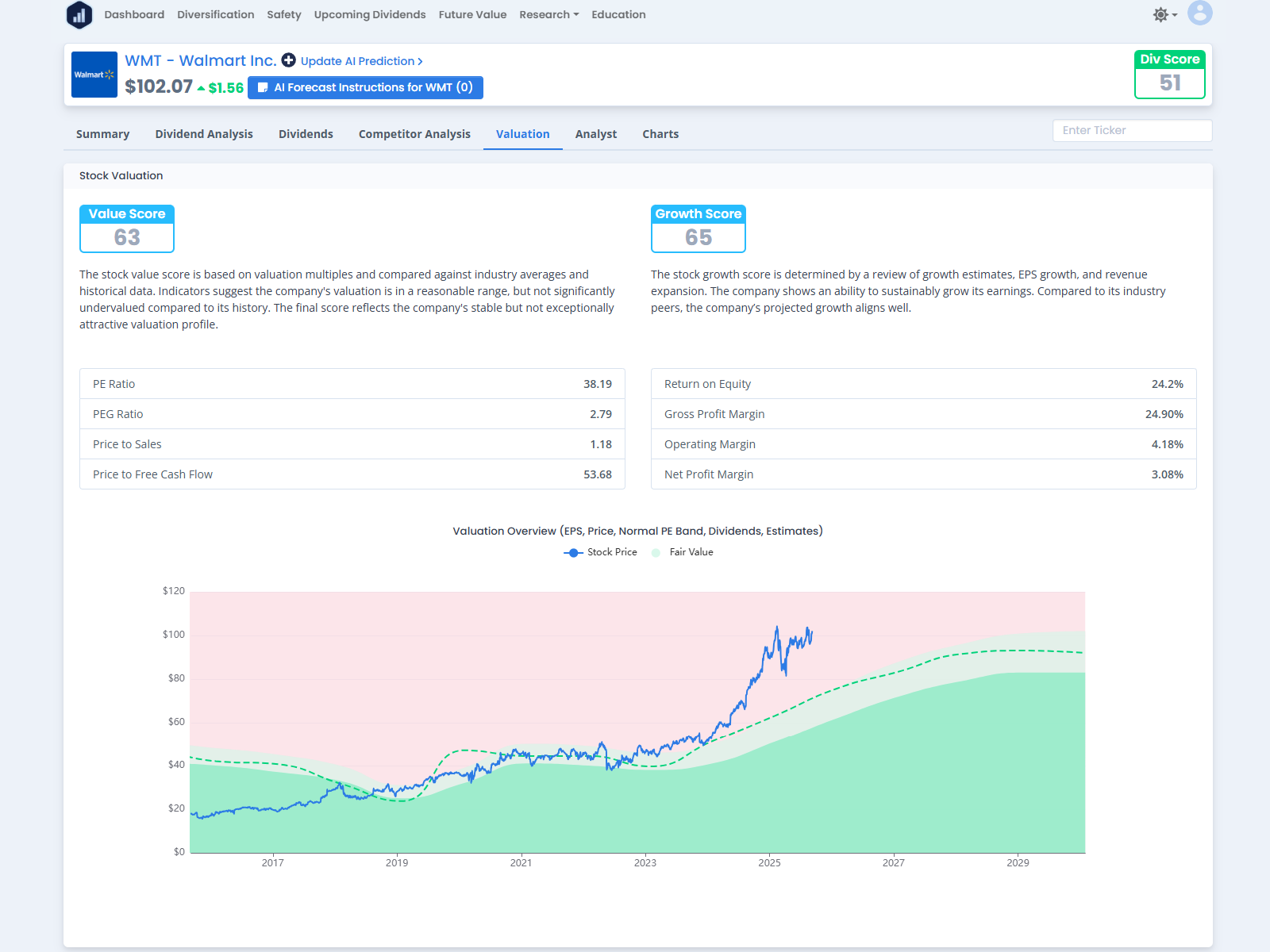

Valuation

Look at the current price to see how it measures up against historical averages, P/E, P/S and Discounted Cash Flow

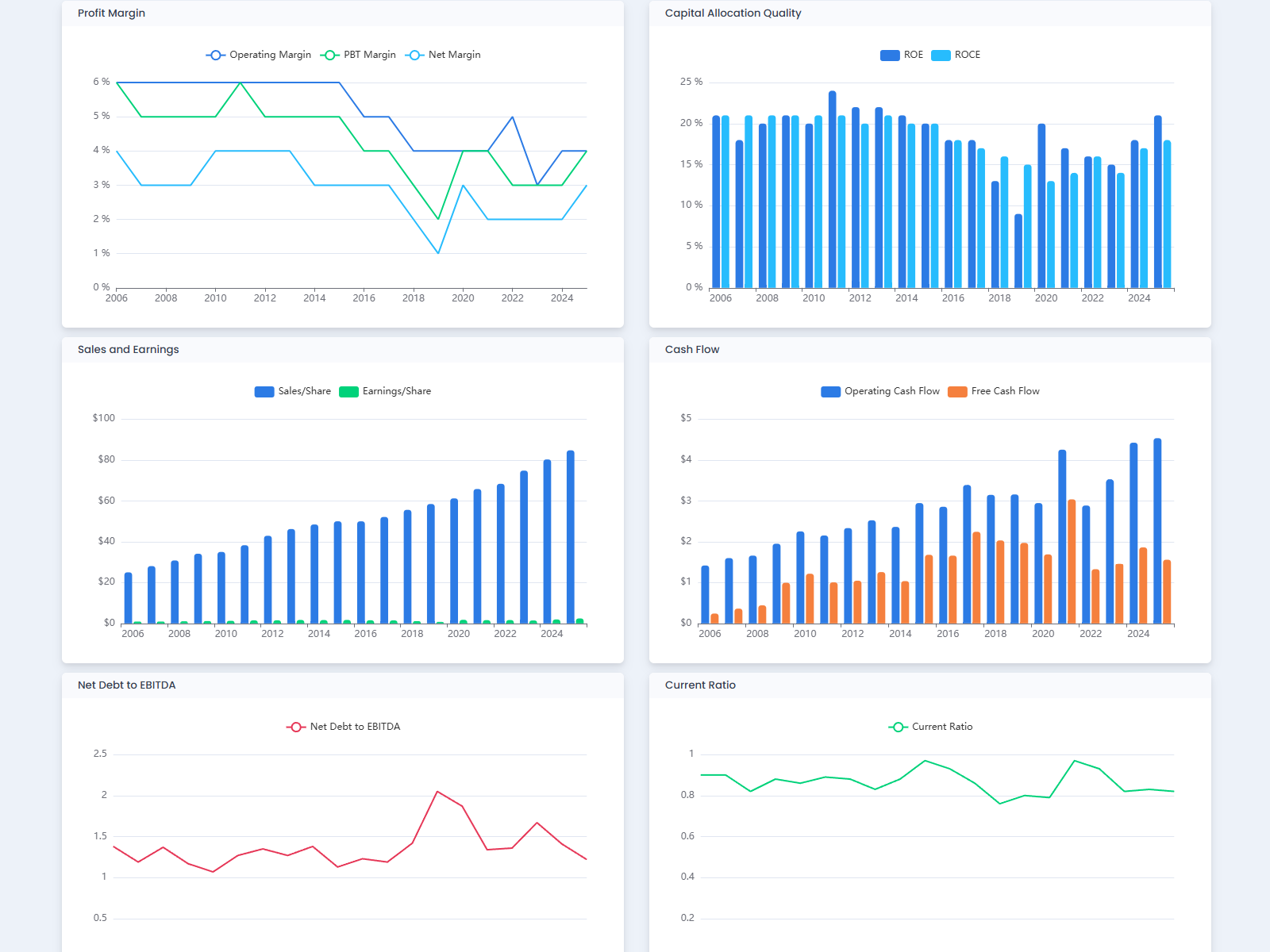

Fundamental Charting

A continually growing page of charts to visually evaluate the company on historical figures and common financial metrics